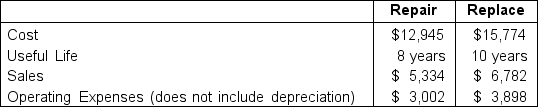

Sharon is the lead salesperson for U-Link, a telecommunications company. The company has been looking into ways that it can become more secure. One of the big decisions being considered by management is addressing the current security system they have in place at their corporate headquarters. In doing so, U-Link can expand its offerings to include on-site data storage. Sharon has narrowed the choices down to either fixing the existing system (Repair) or purchasing a replacement system (Replace). She has gathered pertinent information to perform some analysis:  U-Link has been in business for a number of years and knows that something must change in order for their business to continue to grow. U-link has a Required Rate of Return of 8.2%, has a Weighted Average Cost of Capital (WACC) of 6.4%, a tax rate of 21%, and will use the straight-line depreciation method. (Do not round your calculations.)

U-Link has been in business for a number of years and knows that something must change in order for their business to continue to grow. U-link has a Required Rate of Return of 8.2%, has a Weighted Average Cost of Capital (WACC) of 6.4%, a tax rate of 21%, and will use the straight-line depreciation method. (Do not round your calculations.)

a. What is the Return on Investment (ROI) for each option? Which would be the better choice if the decision was based upon ROI only?

b. What is the Residual Income of each option? What is the Economic Value Added (EVA) of each option?

c. Based upon all the percentages generated, how can all of this data be interpreted? Which choice is the better option for U-Link?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q127: Janice is in charge of the Staining

Q128: After much consideration, Trina has decided sever

Q129: Dot Co. is a paint company, and

Q130: Jonathan is the manager of the equipment

Q131: The lawn and garden center of a

Q133: Tom and Jerry are both managers of

Q134: Montana oversees the Coffee Bean Division at

Q135: Karen owns a small company that has

Q136: The Fizzy Drink Company is a large

Q137: Ingen Production manufactures a top-of-the-line record player,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents