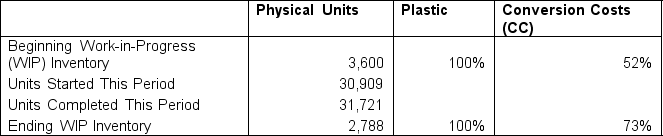

Pete's Gold Co. is a factory that produces gold plastic coins that are sold at party stores around the country. They are attempting to determine whether they would prefer to use the First-In, First-Out (FIFO) or Weighted-Average method for their process costing. Their unit production information for the most recent year is as follows: The units above produced the following costs:

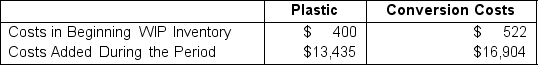

The units above produced the following costs: If Pete's chooses to use the FIFO method, then what is their equivalent cost per unit for Conversion Costs? (Round units to whole number and cost to two decimal places.)

If Pete's chooses to use the FIFO method, then what is their equivalent cost per unit for Conversion Costs? (Round units to whole number and cost to two decimal places.)

A) $0.51

B) $0.52

C) $0.53

D) $0.57

Correct Answer:

Verified

Q71: Yummy Gummies, Co. is a company that

Q72: Scrappy Company is preparing their costing data

Q73: Scrappy Company is preparing their costing data

Q74: Almondz Co. has equivalent costs for Direct

Q75: Almondz Co. has equivalent costs for Direct

Q77: Pete's Gold Co. is a factory that

Q78: The sewing process used by TradeMark Inc.

Q79: The sewing process used by TradeMark Inc.

Q80: The sewing process used by TradeMark Inc.

Q81: At John & Mary Corp., 1,000 units

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents