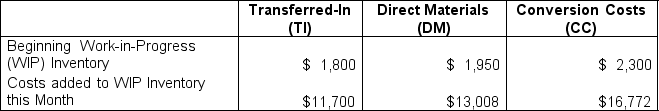

Artemis Inc. manufactures organic cotton dishcloths that it sells in an online store. Their products begin in the cutting department before moving to the sewing department where they are completed. Their accounting department has gathered the following costing information for the month of September: The following represents the equivalent units of production for the month of September:

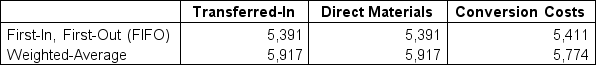

The following represents the equivalent units of production for the month of September: Using the FIFO method, calculate the equivalent cost per unit for Transferred-In (TI) , Direct Materials (DM) , and Conversion Costs (CC) during the month of September. (Round answers to the two decimal places.)

Using the FIFO method, calculate the equivalent cost per unit for Transferred-In (TI) , Direct Materials (DM) , and Conversion Costs (CC) during the month of September. (Round answers to the two decimal places.)

A) TI, $2.17 per unit; DM, $2.41 per unit; and CC, $3.10 per unit

B) TI, $2.17 per unit; DM, $2.41 per unit; and CC, $3.52 per unit

C) TI, $2.41 per unit; DM, $2.17 per unit; and CC, $3.10 per unit

D) TI, $2.50 per unit; DM, $2.77 per unit; and CC, $3.52 per unit

Correct Answer:

Verified

Q91: An organization follows the Weighted-Average method of

Q92: Carmine Inc. creates all of its parts

Q93: Carmine Inc. creates all of its parts

Q94: Stryker Industries produces stethoscopes made from steel

Q95: Stryker Industries produces stethoscopes made from steel

Q97: Artemis Inc. manufactures organic cotton dishcloths that

Q98: A factory manufactures sterling silver hoop earrings

Q99: A factory manufactures sterling silver hoop earrings

Q100: Annie, the accountant for a local cookie

Q101: An organization specializes in manufacturing wooden wardrobes.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents