Fly Ball Inc. is a sporting goods company that produces baseballs and baseball mitts that it sells online. Fly Ball has implemented Activity-Based Costing (ABC) and is in the process of compiling a budget for the coming year. Their Manufacturing Overhead (MOH) is comprised of the following costs:

Setups $98,500 (18,000 setups)

Quality Inspections $104,620 (29,300 inspections)

Factory Supervisor Wages $122,480 (8,600 hours)

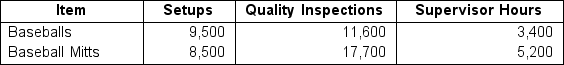

Fly Ball anticipates the production of 15,482 baseballs and 9,877 baseball mitts. Each product is projected to use company resources in the following manner:

(If required, round calculations to two decimal places.)

(If required, round calculations to two decimal places.)

a. What is the total MOH cost for the baseballs?

b. What is the total amount of MOH allocated per unit to the baseballs?

c. What is the total MOH cost for the baseball mitts?

d. What is the total amount of MOH allocated per unit to the baseball mitts?

e. Why should Fly Ball seriously consider implementing ABC instead of their current traditional costing system?

Correct Answer:

Verified

This question requires ca...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: Trivium Inc. is a retail business that

Q132: Santana is a staff accountant for Tapestry,

Q133: Bill owns Owens Construction, a small general

Q134: Aubrey is an accountant for Arbor Town,

Q135: Tech Squad is a regional call center

Q136: Lilly Corp. manufactures office supplies that it

Q138: Garden Variety is an organization that manufactures

Q139: Magic Golf is a small putt putt

Q140: Lately Twisty Noodles, a regional factory that

Q141: Primrose Inc. manufactures high quality hair care

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents