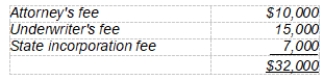

Calvin Company incurred the following costs related to the start-up of the business:

The company wishes to amortize these costs over the maximum period allowed under generally accepted accounting principles. Assuming that Calvin Company began operation on January 1, 2008, what amount of the start-up costs should be amortized in 2009?

A) $4,400

B) $2,200

C) $800

D) $0

Correct Answer:

Verified

Q34: The following information is available for Barkley

Q35: Mining Company acquired a patent on an

Q36: Twilight Corporation acquired End-of-the-World Products on January

Q37: In 2005, Hume, Inc. purchased Rousseau Metals

Q38: Isa Company has equipment that, due to

Q40: In 2008, Edwards Corporation incurred research and

Q41: Hall Co. incurred research and development costs

Q42: Martin Inc. incurred the following costs during

Q43: MaBelle Corporation incurred the following costs in

Q44: On June 30, 2008, Cey, Inc. exchanged

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents