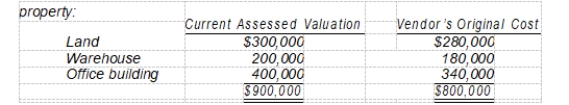

On April 1, Renner Corporation purchased for $855,000 a tract of land on which was located a warehouse and office building. The following data were collected concerning the What are the appropriate amounts that Renner should record for the land, warehouse, and office building, respectively?

What are the appropriate amounts that Renner should record for the land, warehouse, and office building, respectively?

A) Land, $280,000; warehouse, $180,000; office building, $340,000.

B) Land, $300,000; warehouse, $200,000; office building, $400,000.

C) Land, $299,250; warehouse, $192,375; office building, $363,375.

D) Land, $285,000; warehouse, $190,000; office building, $380,000.

Correct Answer:

Verified

Q30: Which of the following statements is true

Q31: The cost of the land that should

Q32: The cost of the building that should

Q33: On February 1, 2008, Morgan Corporation purchased

Q34: On December 1, Wynne Corporation exchanged 2,000

Q36: Herman Company exchanged 400 shares of Daily

Q37: On January 1, 2007, Carson Company purchased

Q38: Sears Corporation, which has a calendar year

Q39: On January 1, 2008, the Accumulated Depreciation-Machinery

Q40: During 2008, Geiger Co. sold equipment that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents