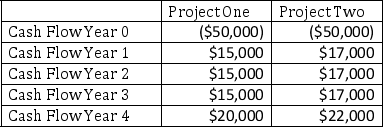

Steif Corporation has two investment projects it is considering. Financial capital is scarce, so Steif wants to choose the project that promises the highest returns to the company and its shareholders. The company's weighted average cost of capital is 14%. The projected cash flows from both projects are given below.

Required:

Required:

a) Calculate the present value of each of the projects using the 14% weighted average cost of capital as the discount rate.

b) Which, if either, of the projects should the company choose? Why?

Correct Answer:

Verified

a)

b)

Steif...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: Which of the following is an incorrect

Q56: Kern Manufacturing has several divisions and evaluates

Q57: Which of the following is a drawback

Q58: For several years, Northern Division of Marino

Q59: Pinehurst Company has two divisions, Household Appliances

Q60: Oakmont Company has two divisions, Household Appliances

Q61: A drawback to the use of residual

Q62: Star Products, Inc., produces safety equipment for

Q63: AP Industries has two divisions, located in

Q65: A company has two service departments, S1

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents