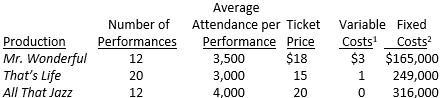

Starlight Theater stages a number of summer musicals at its theater in northern Ohio. Preliminary planning has just begun for the upcoming season, and Starlight has developed the following estimated data. 1 Represent payments to production companies and are based on tickets sold.

1 Represent payments to production companies and are based on tickets sold.

2 Costs directly associated with the entire run of each production for costumes, sets, and artist fees.

Starlight will also incur $565,000 of common fixed operating charges (administrative overhead, facility costs, and advertising) for the entire season, and is subject to a 30% income tax rate. If management desires Mr. Wonderful to produce an after-tax contribution of $210,000 toward the firm's overall operating income for the year, total attendance for the production would have to be:

A) 20,800.

B) 25,000.

C) 25,833.

D) 31,000.

Correct Answer:

Verified

Q32: Phillips & Company produces educational

Q33: All of the following are assumptions

Q34: Ace Manufacturing plans to produce

Q35: Carson Inc. manufactures only one product

Q36: MetalCraft produces three inexpensive socket

Q38: Bargain Press is considering publishing a

Q39: Breakeven quantity is defined as the

Q40: For the year just ended, Silverstone

Q41: Breeze Company has a contribution margin

Q42: Wilkinson Company sells its single product

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents