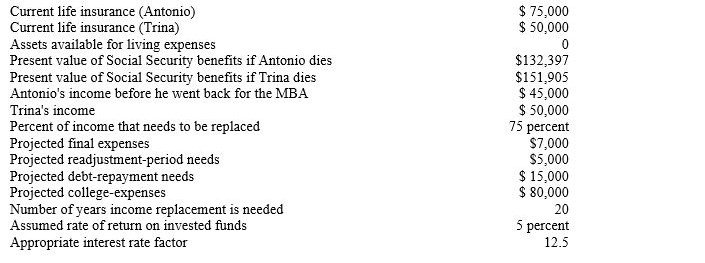

Antonio and Trina are a young couple with two small children, Jason (age four) and Claudia (age two) . Trina is an account executive for a brokerage firm while Antonio has taken a couple years off from his profession as a civil engineer to work on an MBA degree. Right now Antonio and Trina's budget is very tight, as they are accustomed to living on two incomes, but Trina's employer has just circulated employer benefit information, so Antonio and Trina believe this is a good time to evaluate their life insurance needs. They have listed the financial information they believe is relevant.

-Antonio and Trina decide to purchase a $300,000 policy on Trina and a $250,000 policy on Antonio.How much would these policies cost if they were $0.92 per $1,000 of coverage for Tina and $0.98 per $1,000 for Antonio?

A) $230

B) $294

C) $521

D) $524

Correct Answer:

Verified

Q197: Typically,when one borrows from his or her

Q198: Q199: Jonna purchased a $25,000 cash value policy Q200: If Brent is concerned about not being Q201: Antonio and Trina are a young couple Q203: The most important feature of a life Q204: Antonio and Trina are a young couple Q205: Antonio and Trina are a young couple Q206: A survivor's blackout period is the time Q207: Underwriting is the process of insurance companies![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents