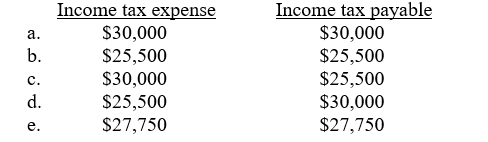

Jay Corp.'s income before income tax is $100,000 and taxable income is $85,000. Assuming a flat tax rate of 30%, Jay's income tax expense and income tax payable are what amounts?

Correct Answer:

Verified

Q20: Use the following information to answer questions

Q21: Use the following information to answer questions

Q22: Use the following information to answer questions

Q23: Use the following information to answer questions

Q24: Pilgrim Incorporated reported $275,000 in taxable income

Q26: A temporary difference is caused by

A) inconsistencies

Q27: In the first year of an asset's

Q28: The following information is included in Tilden's

Q29: Information about discontinued operations is shown

A) in

Q30: Which of the following events is an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents