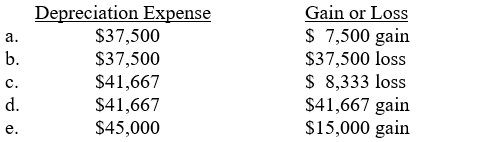

Blair Inc. bought a $1,000,000 machine on January 1, 2004. Blair estimated that the machine would have a salvage value of $100,000 at the end of its 20 year useful life. Blair uses the straight-line method of depreciation. Blair sold the machine to New York Inc. on October 31, 2010 for $700,000 cash. How much depreciation expense should Blair recognize in 2010, and what gain or loss should Blair recognize from the sale of the plane to New York Inc.?

Correct Answer:

Verified

Q34: Use the following information to answer questions

Q35: Use the following information to answer questions

Q36: Use the following information to answer questions

Q37: Use the following information to answer questions

Q38: Use the following information to answer questions

Q40: Loli Ice Cream Services purchased an ice-cream

Q41: Which of the following is not a

Q42: Allocating the cost of natural resources to

Q43: The Deep Hole Company recently paid $2,400,000

Q44: Use the following information to answer questions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents