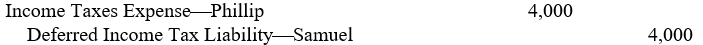

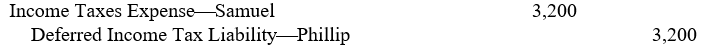

The unrealized intercompany profit in the February 28, 2006, end-of-fiscal year inventories of Samuel Company, the 80%-owned subsidiary of Phillip Corporation, was $10,000, based on billed prices of the merchandise received by Samuel from Phillip. If Phillip and Samuel file separate income tax returns, the criteria for recognizing a deferred tax asset without a valuation allowance are met, and the income tax rate is 40%, which of the following working paper eliminations (explanation omitted) is appropriate for Phillip Corporation and subsidiary on February 28, 2006?

A)

B)

C)

D)

Correct Answer:

Verified

Q16: In the preparation of a consolidated statement

Q17: Ply Corporation acquired the outstanding common stock

Q18: Which of the following is not included

Q19: Included in the identifiable net assets of

Q20: The starting point for the computation of

Q22: Included in the working paper eliminations for

Q23: Parle Corporation and its 80%-owned subsidiary, Sabe

Q24: The sales of merchandise by Pater Corporation

Q25: The working paper eliminations (in journal entry

Q26: On May 1, 2005, the beginning of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents