Lucy Cook, CPA, J.D., provides accounting and tax and legal services to her clients. In 2007, she charged $175 per hour for accounting and $200 per hour for tax and legal services. Erin estimates the following

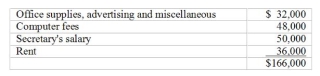

costs for the year 2008.

costs for the year 2008.

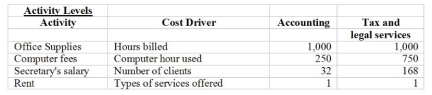

Operating profits declined last year and Ms. Cook has decided to use activity based costing ABC. procedures to evaluate her hourly fees. She has gathered the following information from last year's

records:

records:

Required:

(a) What is the total cost allocated to Accounting services using Activity-Based costing ABC.?

(b) Lucy wants her hourly fees for the tax and legal services to be 200% of their activity-based costs. What is the fee per hour for each type of service Lucy offers?

(c) A major client has requested accounting services. However, Lucy is already billing 100% of her capacity (2,000 hours per year) and is reluctant to shift 200 hours away from her tax and legal services to meet this client's request. What is the minimum fee per hour that Lucy could charge this client for accounting services and be no worse off than last year? Assume that Activity-Based Costing ABC. is used.

(d) Without regard to your answer in requirement c, assume that Lucy must charge $300 per hour to shift the client's work from tax and legal services to accounting services. What would you advise Lucy to do?

Correct Answer:

Verified

(c)

Last year's profits = $1...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Q81: Match each of the following resources with Q82: Arlington Marketing Research is a local market Q83: Hutchings Company manufactures and distributes two products, Q84: The Bridgewater Company recently switched to activity Q86: A medical equipment manufacturer produces two major Q87: Consider the following information for Basin Head Q88: Consider the following ABC Full Costing Report Q89: Refer to the following information concerning products Q90: Badger Boards, Inc. BBI) is a manufacturer![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents