Multiple Choice

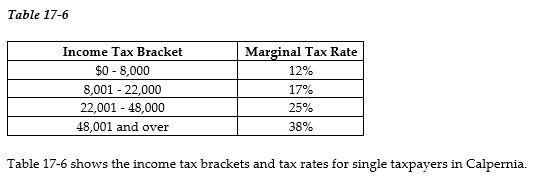

-Refer to Table 17-6. Sasha is a single taxpayer with an income of $60,000. What is his marginal tax rate and what is his average tax rate?

A) marginal tax rate = 38%; average tax rate = 23%

B) marginal tax rate = 17%; average tax rate = 21%

C) marginal tax rate = 38%; average tax rate = 24%

D) marginal tax rate = 23%; average tax rate = 38%

Correct Answer:

Verified

Related Questions

Q10: Q11: If you pay $2,000 in taxes on Q12: If you pay $2,000 in taxes on![]()