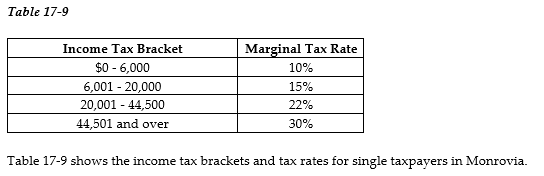

-Refer to Table 17-9. Sylvia is a single taxpayer with an income of $70,000. What is her marginal tax rate and what is her average tax rate?

A) marginal tax rate = 30%; average tax rate = 30%

B) marginal tax rate = 8%; average tax rate = 19.3%

C) marginal tax rate = 30%; average tax rate = 22.5%

D) marginal tax rate = 20%; average tax rate = 30%

Correct Answer:

Verified

Q17: Of the following sources of tax revenue

Q18: Q19: According to projections for 2019 by the Q20: Q21: Q23: A wealth tax like the one proposed Q24: Perhaps the greatest efficiency loss from a Q25: In 2018, which type of tax raised Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()