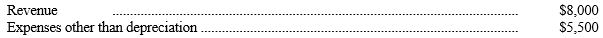

Physician's Pharmacy is considering the purchase of a copying machine, which it will make available to customers at a per-copy charge. The copying machine has an initial cost of $7,500, an estimated useful life of five years, and an estimated salvage value of $500. The estimated annual revenue and expenses relating to operation of the machine are as follows:

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

-Refer to the above data. The net present value of the proposed investment, discounted at an annual rate of 15% and rounded to the nearest dollar, is (tables show that using a discount rate of 15%, the present value of $1 due in five years is 0.497, and the present value of a five year $1 annuity is 3.352) :

A) $528.

B) $(1,405)

C) $1,128.50

D) Some other amount.

Correct Answer:

Verified

Q5: Stone Mfg. is considering expanding operations by

Q6: Physician's Pharmacy is considering the purchase of

Q7: Physician's Pharmacy is considering the purchase of

Q8: Physician's Pharmacy is considering the purchase of

Q9: Physician's Pharmacy is considering the purchase of

Q11: Port Pharmacy is considering the purchase of

Q12: Beacon Manufacturing, Inc. is planning to buy

Q13: Beacon Manufacturing, Inc. is planning to buy

Q14: Beacon Manufacturing, Inc. is planning to buy

Q15: Beacon Manufacturing, Inc. is planning to buy

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents