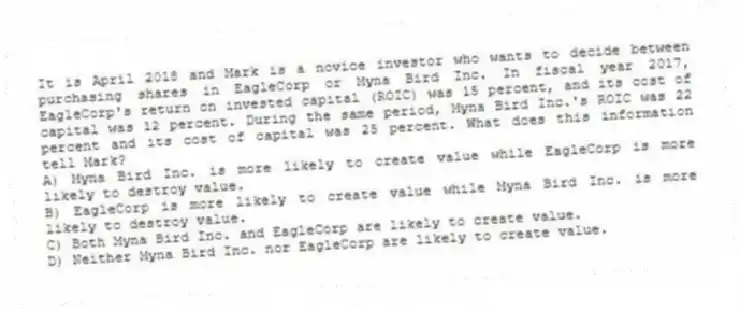

It is April 2018 and Mark is a novice investor who wants to decide between purchasing shares in EagleCorp or Myna Bird Inc. In fiscal year 2017, EagleCorp's return on invested capital (ROIC) was 15 percent, and its cost of capital was 12 percent. During the same period, Myna Bird Inc.'s ROIC was 22 percent and its cost of capital was 25 percent. What does this information tell Mark?

A) Myna Bird Inc. is more likely to create value while EagleCorp is more likely to destroy value.

B) EagleCorp is more likely to create value while Myna Bird Inc. is more likely to destroy value.

C) Both Myna Bird Inc. and EagleCorp are likely to create value.

D) Neither Myna Bird Inc. nor EagleCorp are likely to create value.

Correct Answer:

Verified

Q11: A company's total asset base consists of

Q12: The ratio Cost of goods sold/Revenue indicates

Q13: Managers must first develop a strategy that

Q14: A manager's only responsibility is to monitor

Q15: _ precisely indicates how much of a

Q17: The ratio of SG&A/Revenue is an indicator

Q18: Which of the following statements is true

Q19: The efficient market hypothesis suggests that the

Q20: The working capital turnover of Tesva Systems

Q21: _, which is the return on risk

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents