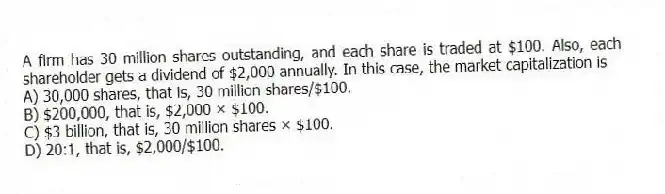

A firm has 30 million shares outstanding, and each share is traded at $100. Also, each shareholder gets a dividend of $2,000 annually. In this case, the market capitalization is

A) 30,000 shares, that is, 30 million shares/$100.

B) $200,000, that is, $2,000 × $100.

C) $3 billion, that is, 30 million shares × $100.

D) 20:1, that is, $2,000/$100.

Correct Answer:

Verified

Q20: The working capital turnover of Tesva Systems

Q21: _, which is the return on risk

Q22: _ is best described as the difference

Q23: The difference between the price charged for

Q24: Which of the following competitively important assets

Q26: Unlike the financial ratios based on accounting

Q27: _ denotes the dollar amount a consumer

Q28: Return on risk capital primarily includes

A) stock

Q29: A watchmaking company has priced one of

Q30: Both Saturn Technologies and Granite Inc. incur

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents