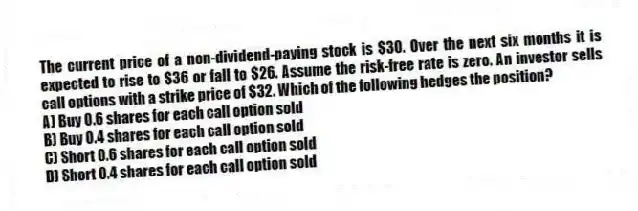

The current price of a non-dividend-paying stock is $30. Over the next six months it is expected to rise to $36 or fall to $26. Assume the risk-free rate is zero. An investor sells call options with a strike price of $32. Which of the following hedges the position?

A) Buy 0.6 shares for each call option sold

B) Buy 0.4 shares for each call option sold

C) Short 0.6 shares for each call option sold

D) Short 0.4 shares for each call option sold

Correct Answer:

Verified

Q1: The current price of a non-dividend-paying stock

Q4: The current price of a non-dividend-paying stock

Q6: When moving from valuing an option on

Q7: The current price of a non-dividend-paying stock

Q7: The current price of a non-dividend paying

Q9: Which of the following are NOT true

A)

Q10: In a binomial tree created to value

Q10: If the volatility of a stock is

Q12: Which of the following describes how American

Q15: Which of the following is NOT true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents