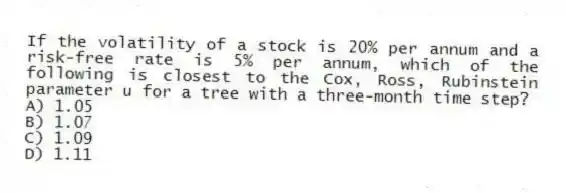

If the volatility of a stock is 20% per annum and a risk-free rate is 5% per annum, which of the following is closest to the Cox, Ross, Rubinstein parameter u for a tree with a three-month time step?

A) 1.05

B) 1.07

C) 1.09

D) 1.11

Correct Answer:

Verified

Q1: The current price of a non-dividend-paying stock

Q6: When moving from valuing an option on

Q7: The current price of a non-dividend paying

Q9: Which of the following are NOT true

A)

Q12: Which of the following describes how American

Q13: A stock is expected to return 10%

Q15: Which of the following is NOT true

Q15: A tree is constructed to value an

Q16: Which of the following is true for

Q18: In a binomial tree created to value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents