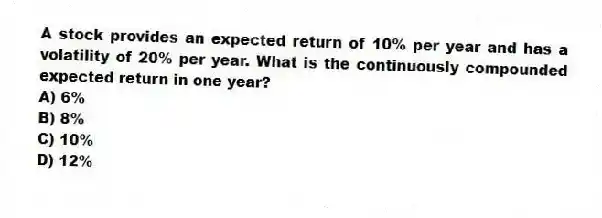

A stock provides an expected return of 10% per year and has a volatility of 20% per year. What is the continuously compounded expected return in one year?

A) 6%

B) 8%

C) 10%

D) 12%

Correct Answer:

Verified

Q5: The risk-free rate is 5% and the

Q6: What does N(x)denote?

A) The area under a

Q8: The original Black-Scholes and Merton papers on

Q9: When the non-dividend paying stock price is

Q11: Which of the following is NOT true?

A)

Q14: When the Black-Scholes-Merton and binomial tree models

Q16: What is the number of trading days

Q17: When the non-dividend paying stock price is

Q17: Which of the following is a definition

Q20: A stock price is $100.Volatility is estimated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents