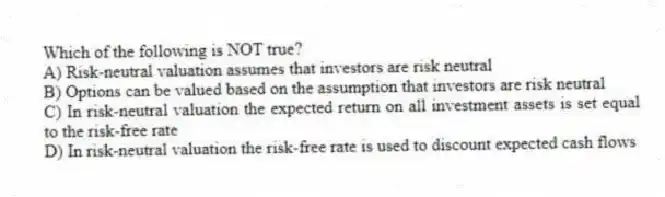

Which of the following is NOT true?

A) Risk-neutral valuation assumes that investors are risk neutral

B) Options can be valued based on the assumption that investors are risk neutral

C) In risk-neutral valuation the expected return on all investment assets is set equal to the risk-free rate

D) In risk-neutral valuation the risk-free rate is used to discount expected cash flows

Correct Answer:

Verified

Q2: Which of the following is assumed by

Q3: An investor has earned 2%,12% and -10%

Q5: The risk-free rate is 5% and the

Q6: A stock provides an expected return of

Q8: The original Black-Scholes and Merton papers on

Q12: A stock price is 20,22,19,21,24,and 24 on

Q13: The volatility of a stock is 18%

Q13: What was the original Black-Scholes-Merton model designed

Q17: Which of the following is a definition

Q20: A stock price is $100.Volatility is estimated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents