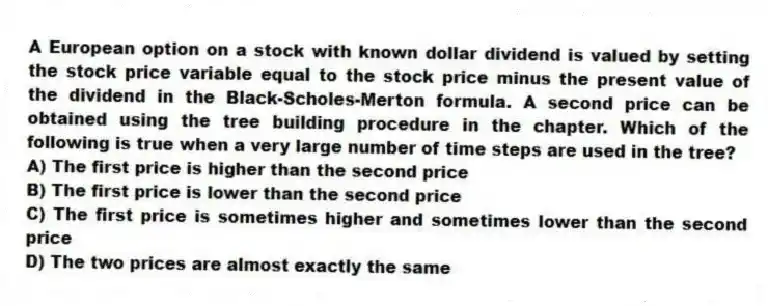

A European option on a stock with known dollar dividend is valued by setting the stock price variable equal to the stock price minus the present value of the dividend in the Black-Scholes-Merton formula. A second price can be obtained using the tree building procedure in the chapter. Which of the following is true when a very large number of time steps are used in the tree?

A) The first price is higher than the second price

B) The first price is lower than the second price

C) The first price is sometimes higher and sometimes lower than the second price

D) The two prices are almost exactly the same

Correct Answer:

Verified

Q2: When the volatility of an option increases

Q4: What is the difference between valuing an

Q5: For an option on futures, the volatility

Q6: Which of the following is true for

Q8: For an option on futures, the volatility

Q9: Which of the following cannot be estimated

Q9: A binomial tree prices an American option

Q12: How many different paths are there through

Q14: Which of the following is possible in

Q17: The chapter discusses an alternative to the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents