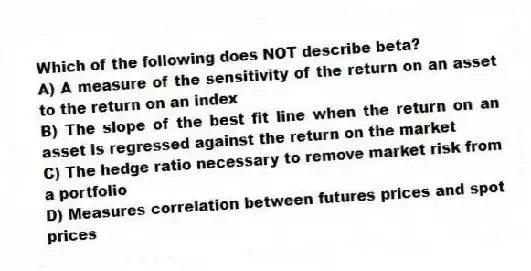

Which of the following does NOT describe beta?

A) A measure of the sensitivity of the return on an asset to the return on an index

B) The slope of the best fit line when the return on an asset is regressed against the return on the market

C) The hedge ratio necessary to remove market risk from a portfolio

D) Measures correlation between futures prices and spot prices

Correct Answer:

Verified

Q2: On March 1 a commodity's spot price

Q5: The basis is defined as spot minus

Q7: Which of the following best describes the

Q10: Futures contracts trade with every month as

Q13: Which of the following best describes "stack

Q16: Which of the following is true?

A) Hedging

Q17: On March 1 the price of a

Q18: A company has a $36 million portfolio

Q19: A company due to pay a certain

Q20: Which of the following is a reason

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents