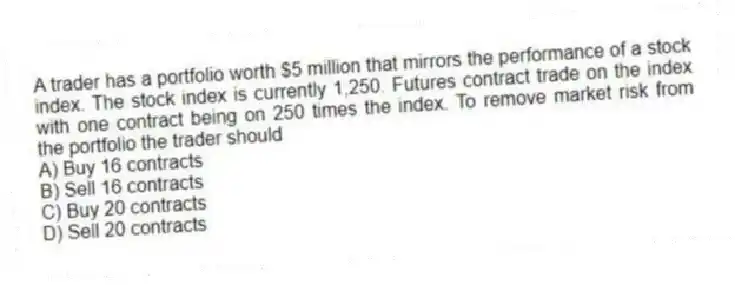

A trader has a portfolio worth $5 million that mirrors the performance of a stock index. The stock index is currently 1,250. Futures contract trade on the index with one contract being on 250 times the index. To remove market risk from the portfolio the trader should

A) Buy 16 contracts

B) Sell 16 contracts

C) Buy 20 contracts

D) Sell 20 contracts

Correct Answer:

Verified

Q4: A one-year call option on a stock

Q5: The price of a stock on February

Q6: A one-year call option on a stock

Q7: An investor sells a futures contract an

Q8: A speculator can choose between buying 100

Q10: The price of a stock on February

Q16: Which of the following is NOT true

A)

Q17: The price of a stock on July

Q18: Which of the following best describes the

Q19: Which of the following is approximately true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents