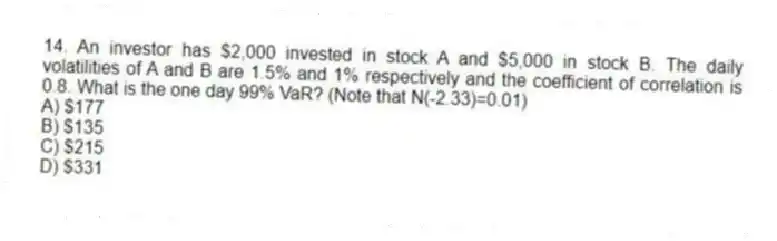

14. An investor has $2,000 invested in stock A and $5,000 in stock B. The daily volatilities of A and B are 1.5% and 1% respectively and the coefficient of correlation is 0.8. What is the one day 99% VaR? (Note that N(-2.33) =0.01)

A) $177

B) $135

C) $215

D) $331

Correct Answer:

Verified

Q2: At the end of Thursday,the estimated volatility

Q5: Which of the following is true of

Q9: Which of the following is true when

Q10: The 10-day VaR is often assumed to

Q10: What does EWMA stand for?

A) Equally weighted

Q11: At the end of Thursday,the estimated volatility

Q12: At the end of Thursday,the estimated covariance

Q14: Which of the following is true of

Q15: If the volatility for a portfolio is

Q18: What is the method of testing how

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents