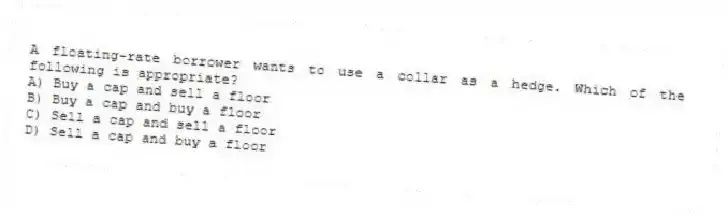

A floating-rate borrower wants to use a collar as a hedge. Which of the following is appropriate?

A) Buy a cap and sell a floor

B) Buy a cap and buy a floor

C) Sell a cap and sell a floor

D) Sell a cap and buy a floor

Correct Answer:

Verified

Q2: Which of the following is assumed to

Q3: In a floor with semiannual reset dates,

Q4: A ten year interest rate cap has

Q5: A Eurodollar futures option contract has a

Q6: Which of the following is true?

A) A

Q8: The price of a December put futures

Q9: In put-call parity for caps and floors,

Q10: What is exchanged when a put option

Q11: A five-year cap is reset annually period.

Q12: A floating-rate lender wants to use a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents