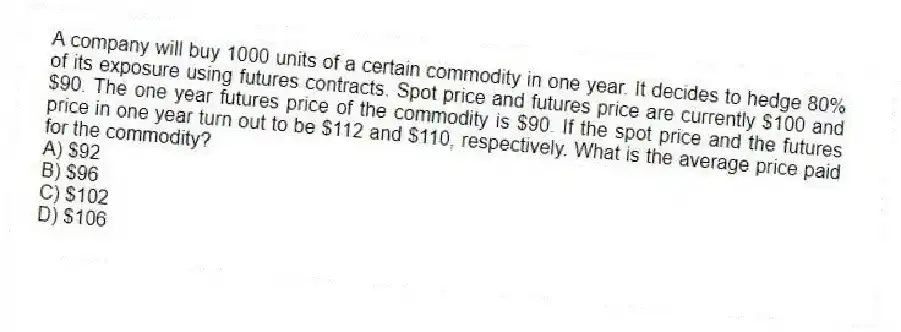

A company will buy 1000 units of a certain commodity in one year. It decides to hedge 80% of its exposure using futures contracts. Spot price and futures price are currently $100 and $90. The one year futures price of the commodity is $90. If the spot price and the futures price in one year turn out to be $112 and $110, respectively. What is the average price paid for the commodity?

A) $92

B) $96

C) $102

D) $106

Correct Answer:

Verified

Q4: Which of the following is true?

A) The

Q7: Which of the following best describes the

Q8: Which of the following increases basis risk?

A)

Q9: A silver mining company has used futures

Q10: Futures contracts trade with every month as

Q11: Which of the following describes tailing the

Q13: Which of the following best describes "stack

Q14: Which of the following is true?

A) Gold

Q17: On March 1 the price of a

Q18: A company has a $36 million portfolio

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents