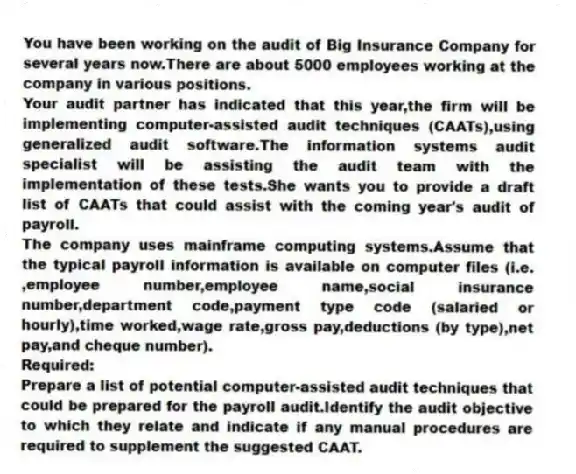

You have been working on the audit of Big Insurance Company for several years now.There are about 5000 employees working at the company in various positions.

Your audit partner has indicated that this year,the firm will be implementing computer-assisted audit techniques (CAATs),using generalized audit software.The information systems audit specialist will be assisting the audit team with the implementation of these tests.She wants you to provide a draft list of CAATs that could assist with the coming year's audit of payroll.

The company uses mainframe computing systems.Assume that the typical payroll information is available on computer files (i.e. ,employee number,employee name,social insurance number,department code,payment type code (salaried or hourly),time worked,wage rate,gross pay,deductions (by type),net pay,and cheque number).

Required:

Prepare a list of potential computer-assisted audit techniques that could be prepared for the payroll audit.Identify the audit objective to which they relate and indicate if any manual procedures are required to supplement the suggested CAAT.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: General controls must be evaluated and their

Q17: Discuss the two most common ways in

Q18: Otto decided to outsource the payroll function

Q19: Which of the following is not a

Q20: What are the risks of error or

Q22: When manufacturing labour affects inventory valuation,a knowledgeable

Q23: The auditor should review the preparation of

Q24: The file for recording each payroll transaction

Q25: When labour is a material factor in

Q26: The internal auditor is running a computer-assisted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents