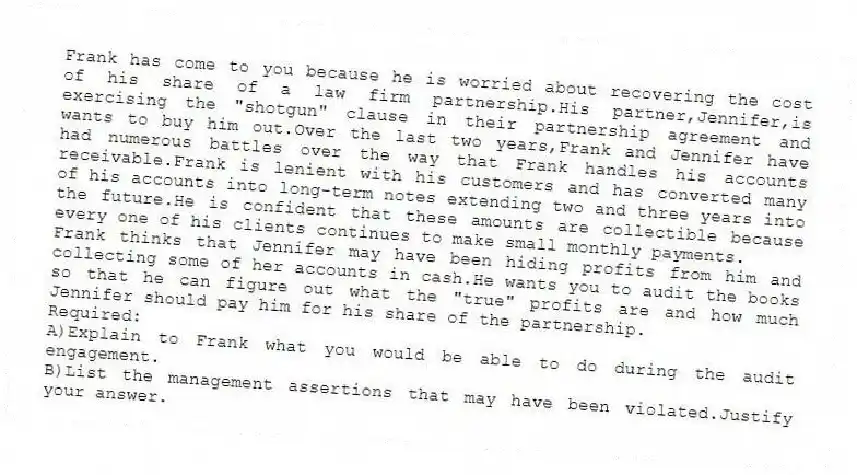

Frank has come to you because he is worried about recovering the cost of his share of a law firm partnership.His partner,Jennifer,is exercising the "shotgun" clause in their partnership agreement and wants to buy him out.Over the last two years,Frank and Jennifer have had numerous battles over the way that Frank handles his accounts receivable.Frank is lenient with his customers and has converted many of his accounts into long-term notes extending two and three years into the future.He is confident that these amounts are collectible because every one of his clients continues to make small monthly payments.

Frank thinks that Jennifer may have been hiding profits from him and collecting some of her accounts in cash.He wants you to audit the books so that he can figure out what the "true" profits are and how much Jennifer should pay him for his share of the partnership.

Required:

A)Explain to Frank what you would be able to do during the audit engagement.

B)List the management assertions that may have been violated.Justify your answer.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: The sole shareholder of Jade Company had

Q45: Gabori Company would like to pay less

Q46: Heavy Manufacturing Company is in the business

Q47: List and explain the assertions that are

Q48: In testing for cutoff,the objective is to

Q50: If the purchase of a long-term note

Q51: Georgina was working as the part-time accountant

Q52: Radio Supplies Limited sells parts and components

Q53: Balance-related audit objectives are applied to which

Q54: When considering each material type (or class)of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents