Multiple Choice

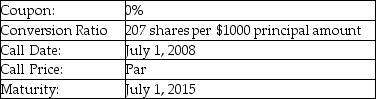

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $4.95.If the bonds are called on this date,which of the following is the action most likely to be taken by a holder of bond of face value of $10,000?

A) Convert the bond and accept shares with a value of $10,000.

B) Convert the bond and accept shares with a value of $10,128.00.

C) Convert the bond and accept shares with a value of $10,239.13.

D) Convert the bond and accept shares with a value of $10,246.50.

E) Accept the call price and receive $10,000.

Correct Answer:

Verified

Related Questions

Q82: Which of the following statements is most

Q83: Which of the following statements regarding a

Q84: A bond has a face value of