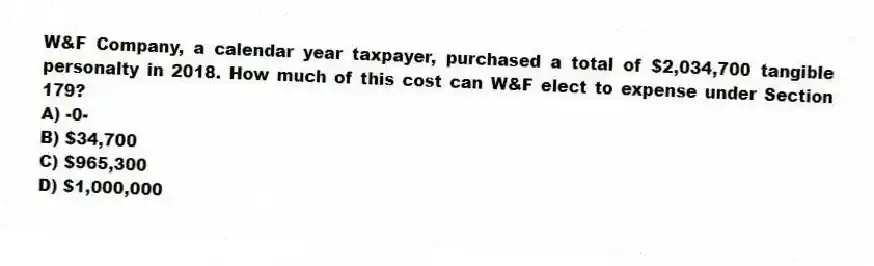

W&F Company, a calendar year taxpayer, purchased a total of $2,034,700 tangible personalty in 2018. How much of this cost can W&F elect to expense under Section 179?

A) -0-

B) $34,700

C) $965,300

D) $1,000,000

Correct Answer:

Verified

Q48: Lensa Inc. purchased machinery several years ago

Q67: Essco Inc., a calendar year taxpayer, made

Q68: Which of the following statements about MACRS

Q69: Norwell Company purchased $1,413,200 of new business

Q72: WR&Z Company,a calendar year taxpayer,paid $6,400,000 for

Q73: Gowda Inc.,a calendar year taxpayer,purchased $1,496,000 of

Q73: Kemp Inc., a calendar year taxpayer, generated

Q75: Dorian,a calendar year corporation,purchased $1,568,000 of equipment

Q75: Pyle Inc., a calendar year taxpayer, generated

Q77: Maxcom Inc. purchased 15 passenger automobiles for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents