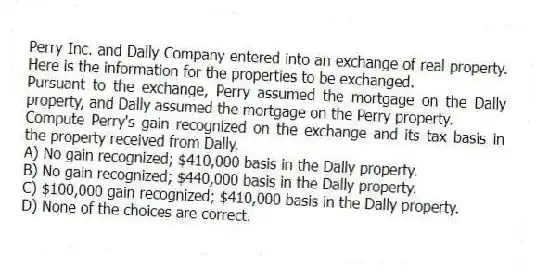

Perry Inc. and Dally Company entered into an exchange of real property. Here is the information for the properties to be exchanged.

Pursuant to the exchange, Perry assumed the mortgage on the Dally property, and Dally assumed the mortgage on the Perry property.

-Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

A) No gain recognized; $410,000 basis in the Dally property.

B) No gain recognized; $440,000 basis in the Dally property.

C) $100,000 gain recognized; $410,000 basis in the Dally property.

D) None of the choices are correct.

Correct Answer:

Verified

Q45: Which of the following statements about boot

Q54: Eliot Inc.transferred an old asset with a

Q55: Nixon Inc. transferred Asset A to an

Q57: Rydell Company exchanged business realty (initial cost

Q60: Which of the following statements about like-kind

Q61: Grantly Seafood is a calendar year taxpayer.

Q63: Perry Inc. and Dally Company entered into

Q64: Babex Inc. and OMG Company entered into

Q68: A fire destroyed furniture and fixtures used

Q71: Thieves stole computer equipment used by Ms.James

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents