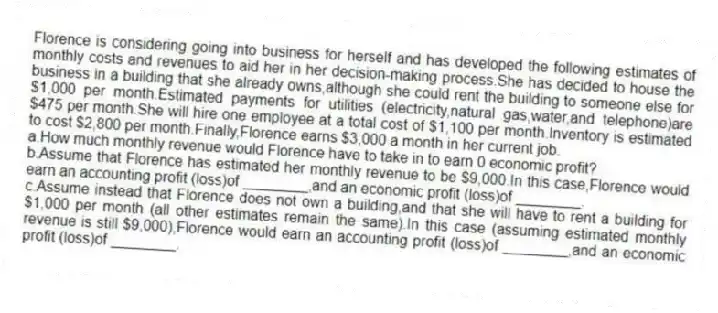

Florence is considering going into business for herself and has developed the following estimates of monthly costs and revenues to aid her in her decision-making process.She has decided to house the business in a building that she already owns,although she could rent the building to someone else for $1,000 per month.Estimated payments for utilities (electricity,natural gas,water,and telephone)are $475 per month.She will hire one employee at a total cost of $1,100 per month.Inventory is estimated to cost $2,800 per month.Finally,Florence earns $3,000 a month in her current job.

a.How much monthly revenue would Florence have to take in to earn 0 economic profit?

b.Assume that Florence has estimated her monthly revenue to be $9,000.In this case,Florence would earn an accounting profit (loss)of ________,and an economic profit (loss)of ________.

c.Assume instead that Florence does not own a building,and that she will have to rent a building for $1,000 per month (all other estimates remain the same).In this case (assuming estimated monthly revenue is still $9,000),Florence would earn an accounting profit (loss)of ________,and an economic profit (loss)of ________.

Correct Answer:

Verified

b.Accounting profit =...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q76: If,for a particular short-run production,we observe that

Q77: One of the interesting findings of a

Q78: The law of diminishing returns is a

Q79: When a firm is considering whether to

Q80: By definition,in the typical firm's short-run production

Q82: A firm's short-run cost functions depend primarily

Q83: All else constant,an improvement in technology would

Q84: In the general textbook treatment,the firm's short

Q85: Empirical evidence indicates that most firms operate

Q86: Assume that at the current level of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents