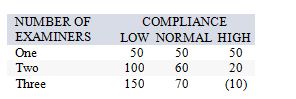

The local operations manager for the Internal Revenue Service must decide whether to hire one, two, or three temporary tax examiners for the upcoming tax season. She estimates that net revenues (in thousands of dollars) will vary with how well taxpayers comply with the new tax code just passed by Congress, as follows:  If she feels the chances of low, medium, and high compliance are 20 percent, 30 percent, and 50 percent respectively, what are the expected net revenues for the number of assistants she will decide to hire?

If she feels the chances of low, medium, and high compliance are 20 percent, 30 percent, and 50 percent respectively, what are the expected net revenues for the number of assistants she will decide to hire?

A) $26,000

B) $46,000

C) $48,000

D) $50,000

E) $76,000

Correct Answer:

Verified

Q75: The operations manager for a well-drilling company

Q76: The owner of Tastee Cookies needs to

Q77: The owner of Tastee Cookies needs to

Q78: The owner of Tastee Cookies needs to

Q79: The local operations manager for the Internal

Q81: The owner of Tastee Cookies needs to

Q82: The advertising manager for Roadside Restaurants, Inc.,

Q84: The advertising manager for Roadside Restaurants, Inc.,

Q85: The advertising manager for Roadside Restaurants, Inc.,

Q105: The head of operations for a movie

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents