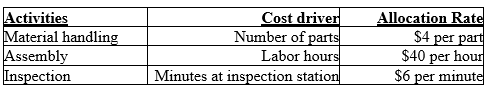

Merrill, Inc. manufactures remote controls. Currently the company uses a plant-wide rate for allocating manufacturing overhead costs. The plant manager believes it is time to refine the method of cost allocation and has the accounting department identify the primary production activities and their cost drivers:

The current traditional cost method allocates overhead costs based on direct labor hours using a rate of $ 400 per labor hour.

-What are the manufacturing overhead costs per remote control assuming the traditional cost method is used and a batch of 500 remote controls are produced? The batch requires 1,000 parts,10 direct labor hours,and 15 minutes of inspection time.

A) $4,000.00 per remote control

B) $0.50 per remote control

C) $4.00 per remote control

D) $8.00 per remote control

Correct Answer:

Verified

Q48: Baldwin Printers has contracts to complete weekly

Q49: Webster Company provides the following

Q50: Blitzer Enterprises has identified three cost pools

Q51: If products are alike,then for costing purposes:

A)a

Q52: Blitzer Enterprises has identified three cost pools

Q54: Baldwin Printers has contracts to complete weekly

Q55: Activity-based costing systems provide better product costs

Q56: Tony's Skate Corporation manufactures two models of

Q57: Merrill, Inc. manufactures remote controls. Currently the

Q58: Blitzer Enterprises has identified three cost pools

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents