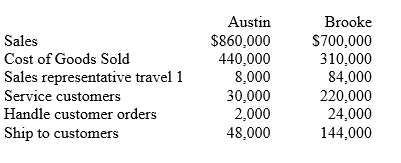

Brent Company's cost system assigns MSDA expenses to customers using a rate of 33% of sales revenue.The new CFO has discovered that Brent's customers differ greatly in their ordering patterns and interaction with Brent's sales force.Because the CFO believes Brent's cost system does not accurately assign MSDA expenses to customers,he developed an ABC system and gathered the following information.

Required:

(a)Using the current cost system's approach of assigning MSDA expenses to customers using a rate of 33% of sales revenue,determine the operating profit associated with Austin and with Brooke.

(b)Using the activity-based costing information provided,determine the operating profit associated with Austin and with Brooke.

(c)Which of the two methods produces more accurate assignments of MSDA expenses to customers? Explain.

Correct Answer:

Verified

(c)

The activity-based costing method ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: High cost to serve customers:

A)have high order

Q7: The pricing waterfall charts revenue leaks from

Q8: MSDA expenses as a percentage of sales

Q9: Marketing,selling,distribution,and administrative expenses:

A)can be traced through causal

Q10: Companies should avoid high cost-to-serve customers because

Q12: Discuss the issues related to excessive focus

Q13: The 80/20 rules states that the top

Q14: The 40-1 rule demonstrates that the top

Q15: Low cost-to-serve customers order in smaller quantities.

Q16: Customized delivery is a characteristic of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents