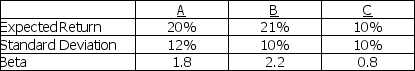

Answer the questions below using the following information on stocks A,B,and C.

Assume the risk-free rate of return is 3% and the expected market return is 12%

a.Calculate the required return for stocks A,B,and C.

b.Assuming an investor with a well-diversified portfolio,which stock would the investor want

to add to his portfolio?

c.Assuming an investor who will invest all of his money into one security,which stock will the investor choose?

Correct Answer:

Verified

S...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q141: Security A has an expected rate of

Q142: The expected return for the market portfolio

Q143: You are considering an investment in Citizens

Q144: Redesign Corp.is considering a new strategy that

Q145: Bankers Corp.has a very conservative beta of

Q146: What are the two components of the

Q147: What is the name given to the

Q149: The minimum rate of return necessary to

Q150: Use the following data:

Market risk premium =

Q151: How does opportunity cost affect an investor's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents