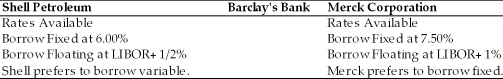

TABLE 15.2

Use the information to answer following question(s) .

-Refer to Table 15.2. Which of the following are viable rates for the swap agreements with Barclay's Bank by Shell and Merck?

A) Shell borrows at a variable rate of LIBOR + 1% and enters into a swap with Barclay's that pays Shell variable LIBOR + 1% while Shell pays Barclay's fixed 7 1/4%. At the same time, Merck borrows at the fixed rate of 6.00% and enters into a swap agreement with Barclay's that pays Merck 6.00% while Merck pays Barclay's LIBOR plus 1/4%.

B) Merck borrows at a variable rate of LIBOR + 1% and enters into a swap with Barclay's that pays Merck variable LIBOR + 1% while Merck pays Barclay's fixed 7 1/4%. At the same time, Shell borrows at the fixed rate of 6.00% and enters into a swap agreement with Barclay's that pays Shell 6.00% while Shell pays Barclay's LIBOR plus 1/4%.

C) Merck borrows at a fixed rate of 7.5% and enters into a swap with Barclay's that pays Merck variable LIBOR + 1% while Merck pays Barclay's fixed 7 1/4%. At the same time, Shell borrows at the variable rate of LIBOR + 1/2% and enters into a swap agreement with Barclay's that pays Shell 6.00% while Shell pays Barclay's LIBOR plus 1/4%.

D) Merck borrows at a variable rate of LIBOR + 1% and enters into a swap with Barclay's that pays Merck a fixed rate of 7% while Merck pays Barclay's variable LIBOR +1%. At the same time, Shell borrows at the fixed rate of 6.00% and enters into a swap agreement with Barclay's that pays Shell 6.00% while Shell pays Barclay's LIBOR plus 1/4%.

Correct Answer:

Verified

Q12: Some of the world's largest and most

Q24: Your firm is faced with paying a

Q44: How does counterparty risk influence a firm's

Q52: Outright techniques of interest rate risk management

Q53: A firm entering into a currency or

Q55: The largest amount of daily trading in

Q56: OTC interest rate derivative daily turnover has

Q58: Counterparty risk is

A) present only with exchange-traded

Q59: Molson Brewery, a Canadian company wishes to

Q60: A combined position of selling one currency

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents