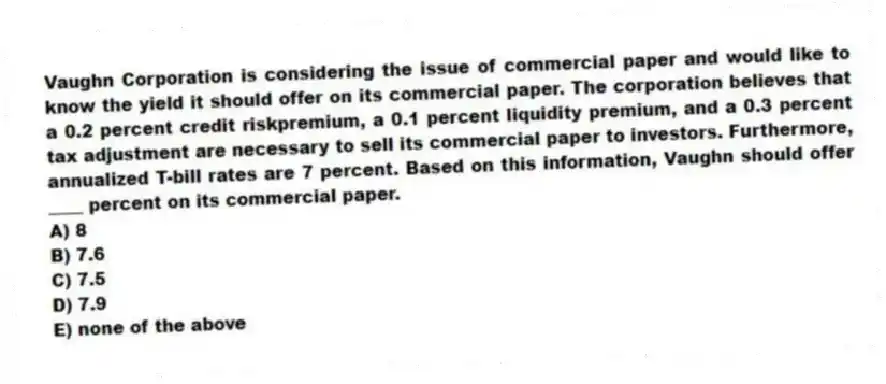

Vaughn Corporation is considering the issue of commercial paper and would like to know the yield it should offer on its commercial paper. The corporation believes that a 0.2 percent credit riskpremium, a 0.1 percent liquidity premium, and a 0.3 percent tax adjustment are necessary to sell its commercial paper to investors. Furthermore, annualized T-bill rates are 7 percent. Based on this information, Vaughn should offer ____ percent on its commercial paper.

A) 8

B) 7.6

C) 7.5

D) 7.9

E) none of the above

Correct Answer:

Verified

Q22: A theory states that while investors and

Q25: According to segmented markets theory, if investors

Q36: The yield curve in a foreign country

Q38: According to the segmented markets theory, if

Q40: The degree to which the Treasury's debt

Q41: You are considering the purchase of a

Q43: Assume that the Treasury experiences a large

Q47: If liquidity influences the yield curve, the

Q48: The higher a bond rating, the lower

Q60: The term structure of interest rates defines

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents