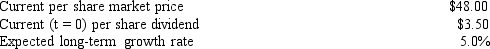

The following financial information is available on Rawls Manufacturing Company:

Rawls can issue new common stock to net the company $44 per share. Determine the cost of internal equity capital using the dividend capitalization model approach. (Compute answer to the nearest 0.1%) .

A) 12.3%

B) 13.4%

C) 13.0%

D) 12.7%

Correct Answer:

Verified

Q6: Studies analyzing the historical returns earned by

Q13: The cost of equity capital for non-dividend

Q19: If a firm adopts a large proportion

Q21: Determine the (after-tax) percentage cost of a

Q22: Which of the following statements (if any)

Q23: Rank in ascending order (lowest to highest)

Q24: The cost of depreciation-generated funds is equal

Q30: If a firm will use only equity

Q37: The major components that determine the risk

Q40: The cost of external equity is greater

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents