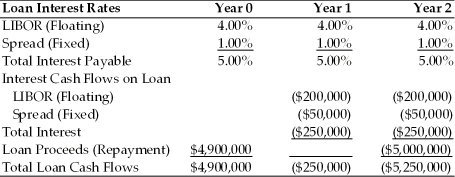

TABLE 7.2

Use the information for Polaris Corporation to answer the following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 7.2. If the LIBOR rate falls to 3.00% after the first year what will be the all-in-cost (i.e. the internal rate of return) for Polaris for the entire loan?

A) 4.00%

B) 4.50%

C) 5.25%

D) 5.60%

Correct Answer:

Verified

Q14: _ is the possibility that the borrower's

Q22: A/an _ is a contract to lock

Q33: An agreement to swap a fixed interest

Q45: TABLE 7.2

Use the information for Polaris Corporation

Q46: For the following problem(s), consider these debt

Q47: For the following problem(s), consider these debt

Q48: For the following problem(s), consider these debt

Q49: TABLE 7.2

Use the information for Polaris Corporation

Q54: For the following problem(s), consider these debt

Q55: For the following problem(s), consider these debt

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents