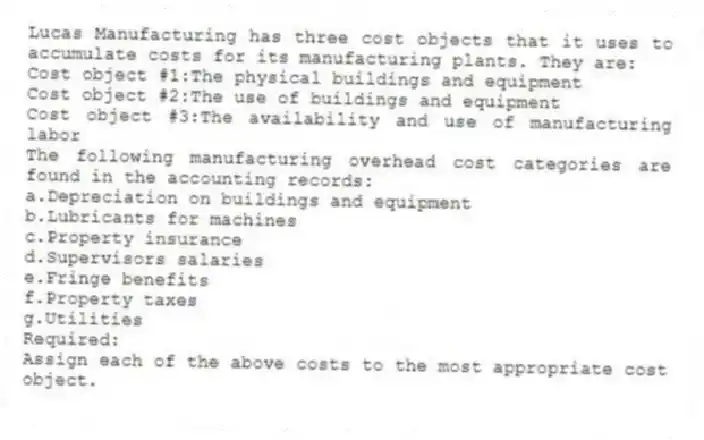

Lucas Manufacturing has three cost objects that it uses to accumulate costs for its manufacturing plants. They are:

Cost object #1:The physical buildings and equipment

Cost object #2:The use of buildings and equipment

Cost object #3:The availability and use of manufacturing labor

The following manufacturing overhead cost categories are found in the accounting records:

a.Depreciation on buildings and equipment

b.Lubricants for machines

c.Property insurance

d.Supervisors salaries

e.Fringe benefits

f.Property taxes

g.Utilities

Required:

Assign each of the above costs to the most appropriate cost object.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Budgeted costs are _.

A) the costs incurred

Q14: Costs are accounted for in two basic

Q15: The determination of a cost as either

Q16: Which of the following factors affect the

Q17: Cost assignment _.

A) includes future and arbitrary

Q19: A cost object is anything for which

Q20: The collection of cost data in an

Q21: A manufacturing plant produces two product lines:

Q22: A direct cost of one cost object

Q23: The broader the cost object definition (i.e.,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents