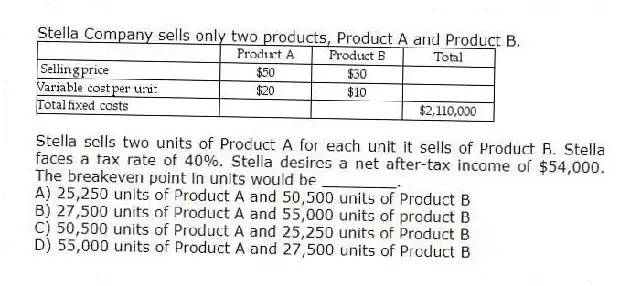

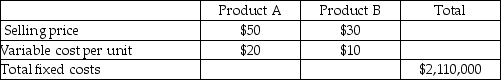

Stella Company sells only two products, Product A and Product B.

Stella sells two units of Product A for each unit it sells of Product B. Stella faces a tax rate of 40%. Stella desires a net after-tax income of $54,000. The breakeven point in units would be ________.

A) 25,250 units of Product A and 50,500 units of Product B

B) 27,500 units of Product A and 55,000 units of product B

C) 50,500 units of Product A and 25,250 units of Product B

D) 55,000 units of Product A and 27,500 units of Product B

Correct Answer:

Verified

Q177: Dolph and Evan started the DE Restaurant

Q178: The following information is for the Jeffries

Q179: Sales mix is the quantities or proportion

Q180: Assuming a constant mix of 3 units

Q181: If a company's sales mix is 2

Q183: Ballpark Concessions currently sells hot dogs. During

Q184: Karen Hefner, a florist, operates retail stores

Q185: Gross Margin will always be greater than

Q186: Gross margin is _.

A) sales revenue less

Q187: In the merchandising sector _.

A) only variable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents