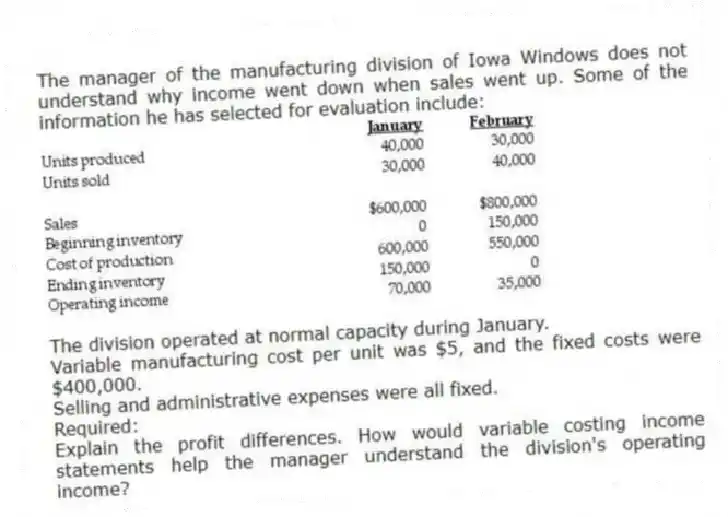

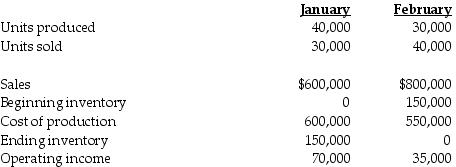

The manager of the manufacturing division of Iowa Windows does not understand why income went down when sales went up. Some of the information he has selected for evaluation include:

The division operated at normal capacity during January.

Variable manufacturing cost per unit was $5, and the fixed costs were $400,000.

Selling and administrative expenses were all fixed.

Required:

Explain the profit differences. How would variable costing income statements help the manager understand the division's operating income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q76: When production is greater than sales, operating

Q77: The production-volume variance only exists under variable

Q78: Given a constant contribution margin per unit

Q79: The contribution-margin format of the income statement

Q80: The production-volume variance, which relates only to

Q82: Many companies have switched from absorption costing

Q83: Ways to "produce for inventory" that result

Q84: Switching production to products that absorb the

Q85: Galliart Company has two identical divisions, East

Q86: Under absorption costing, managers can increase operating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents