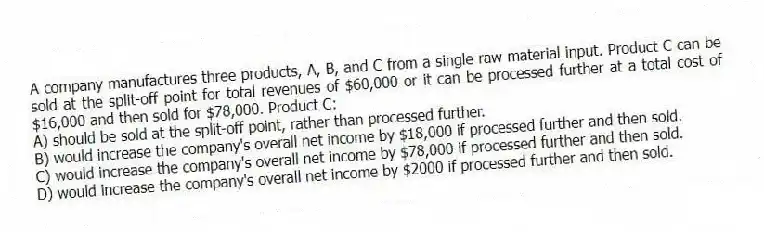

A company manufactures three products, A, B, and C from a single raw material input. Product C can be sold at the split-off point for total revenues of $60,000 or it can be processed further at a total cost of $16,000 and then sold for $78,000. Product C:

A) should be sold at the split-off point, rather than processed further.

B) would increase the company's overall net income by $18,000 if processed further and then sold.

C) would increase the company's overall net income by $78,000 if processed further and then sold.

D) would increase the company's overall net income by $2000 if processed further and then sold.

Correct Answer:

Verified

Q119: The constant gross-margin percentage NRV method allocates

Q120: Calamata Corporation processes a single material into

Q121: What revenue or expense amounts are necessary

Q122: Torid Company processes 17,750 gallons of direct

Q123: Torid Company processes 18,175 gallons of direct

Q125: Which of the following factors would NOT

Q126: Firms should be wary of using the

Q127: All separable costs in joint-cost allocations are

Q128: What are the four methods of allocating

Q129: Torid Company processes 18,700 gallons of direct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents