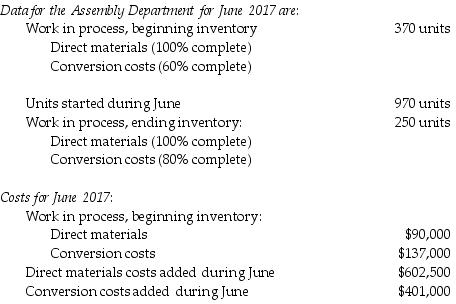

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

What are the equivalent units for direct materials and conversion costs, respectively, for June? (Round final answers to the nearest unit.)

A) 1340 units; 1050 units

B) 1340 units; 1290 units

C) 1220 units; 1220 units

D) 1248 units; 1120 units

Correct Answer:

Verified

Q37: Stefan Ceramics is in the business of

Q38: Charlie Chairs Inc., manufactures plastic moldings for

Q39: Which of the following entries is used

Q40: Dessa Cabinetry, Inc., manufactures standard sized modular

Q41: In the computation of the cost per

Q43: Timekeeper Inc. manufactures clocks on a highly

Q44: Which of the following is not true

Q45: Bright Colors Company placed 315,000 gallons of

Q46: The accounting entry to record the conversion

Q47: Sodius Chemical Inc. placed 220,000 liters of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents