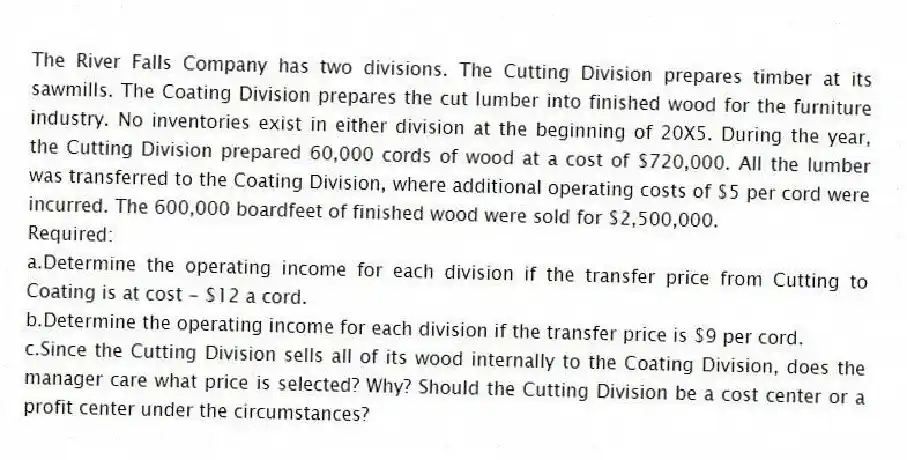

The River Falls Company has two divisions. The Cutting Division prepares timber at its sawmills. The Coating Division prepares the cut lumber into finished wood for the furniture industry. No inventories exist in either division at the beginning of 20X5. During the year, the Cutting Division prepared 60,000 cords of wood at a cost of $720,000. All the lumber was transferred to the Coating Division, where additional operating costs of $5 per cord were incurred. The 600,000 boardfeet of finished wood were sold for $2,500,000.

Required:

a.Determine the operating income for each division if the transfer price from Cutting to Coating is at cost - $12 a cord.

b.Determine the operating income for each division if the transfer price is $9 per cord.

c.Since the Cutting Division sells all of its wood internally to the Coating Division, does the manager care what price is selected? Why? Should the Cutting Division be a cost center or a profit center under the circumstances?

Correct Answer:

Verified

* 60,000 cords × $12 = $720,000

b....

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: Plish Company manufactures only one type of

Q78: The choice of a transfer-pricing method has

Q79: Branded Shoe Company manufactures only one type

Q80: Plish Company manufactures only one type of

Q81: What are distress prices and which transfer

Q83: Aerated Water Company makes internal transfers at

Q84: For each of the following, identify whether

Q85: The cost used in cost-based transfer prices

Q86: Briefly describe the conditions that should be

Q87: Market-based transfer prices are helpful when _.

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents