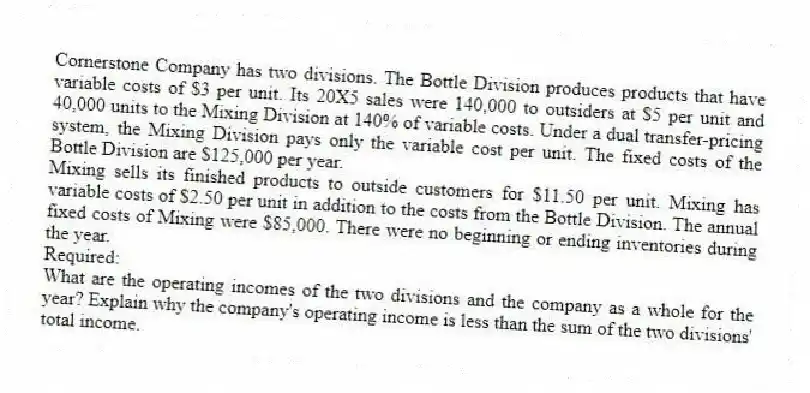

Cornerstone Company has two divisions. The Bottle Division produces products that have variable costs of $3 per unit. Its 20X5 sales were 140,000 to outsiders at $5 per unit and 40,000 units to the Mixing Division at 140% of variable costs. Under a dual transfer-pricing system, the Mixing Division pays only the variable cost per unit. The fixed costs of the Bottle Division are $125,000 per year.

Mixing sells its finished products to outside customers for $11.50 per unit. Mixing has variable costs of $2.50 per unit in addition to the costs from the Bottle Division. The annual fixed costs of Mixing were $85,000. There were no beginning or ending inventories during the year.

Required:

What are the operating incomes of the two divisions and the company as a whole for the year? Explain why the company's operating income is less than the sum of the two divisions' total income.

Correct Answer:

Verified

* 40,000 × $3 × 1.40 = $168,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q115: An advantage of using budgeted costs for

Q116: Cost-based transfer prices are helpful when markets

Q117: When cost-based transfer pricing is used between

Q118: Cost-based transfer prices are often used when

Q119: Which of the following is a disadvantage

Q121: Minimum transfer price can be arrived at

Q122: The minimum transfer price equals _.

A) opportunity

Q123: Dual pricing uses two separate transfer-pricing methods

Q124: The seller of Product A has no

Q125: If the selling subunit is operating at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents