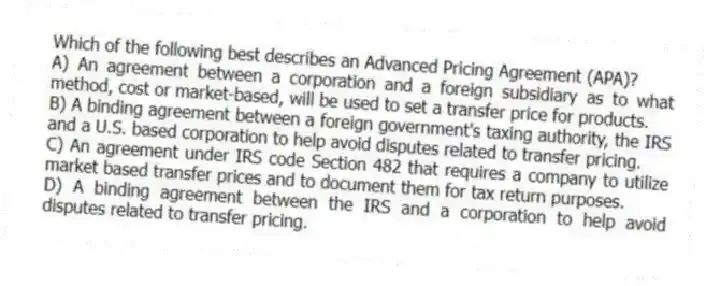

Which of the following best describes an Advanced Pricing Agreement (APA) ?

A) An agreement between a corporation and a foreign subsidiary as to what method, cost or market-based, will be used to set a transfer price for products.

B) A binding agreement between a foreign government's taxing authority, the IRS and a U.S. based corporation to help avoid disputes related to transfer pricing.

C) An agreement under IRS code Section 482 that requires a company to utilize market based transfer prices and to document them for tax return purposes.

D) A binding agreement between the IRS and a corporation to help avoid disputes related to transfer pricing.

Correct Answer:

Verified

Q139: Both the market-based transfer pricing approach and

Q140: Which of the following denotes minimum transfer

Q141: What is the role of unused capacity

Q142: Companies have an incentive to lower the

Q143: The tariffs and customs duties governments levy

Q145: A company has a plant in a

Q146: One of the problems in using one

Q147: Global Giant, a multinational corporation, has a

Q148: Which of the following taxes does transfer

Q149: Which of the following helps in avoiding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents